Staking, Lending And Liquidity Mining – How to Get The Most Out of Your Crypto?

Many concepts in the crypto space can be both complicated and simple –– highly depending on how deep one is willing to dive into these financial innovations. One thing though is certain: If you have ever read about Decentralized Finance (DeFi), then you most likely have already come across terms like Staking, Lending and Liquidity Mining.

Even though these concepts have a lot in common at the first glance, their underlying mechanics are quite different and require an in-depth understanding to be able to make valid financial decisions.

What is Lending?

A lot of crypto enthusiasts are risk-averse in the sense that they are encouraged to save or HODL their crypto currencies in a hardware wallet until the price justifies it to sell them. This is not a great strategy at all and has a lot in common with putting cash under your mattress. That’s why a common question among risk-averse people new to crypto is: How can I grow my crypto portfolio without taking too much risk?

That’s exactly where crypto lending comes into play by guaranteeing savers an interest on their crypto stash. As a result, the days when you were desperate for liquidity are once and for all numbered. No more excuses to give crypto a wide berth, since now you can generate cash flow on most of the leading crypto currencies with just a few clicks.

Crypto lending platforms like Cake DeFi guarantee that your crypto is not just lying around and collecting dust, but that it generates real income for you by lending it to reputable institutional partners, fully insured and risk-free.

Cake DeFi offers one of the highest lending rates in the industry with up to 7% per annum. So what are you waiting for? Take advantage of the savings book 2.0 and let your crypto work for you! Putting your crypto to work has never been easier than that, and Cake DeFi is your trusted partner when it comes to crypto wealth creation.

Lending out your crypto to bigger institutions may already yield you much higher returns than what you would be getting on your bank account. However, you are still missing out on the myriad new investment strategies popping up in the decentralized finance space, where returns north of 100% APY are rather the norm than the exception.

Most of these new strategies involve jumping from protocol to protocol and from one service to another, hunting the highest yields in order to maximize the return. These concepts are summarized under the term “yield farming”.

Two of the most broadly used yield farming strategies are Staking and Liquidity Mining. Both concepts are relatively new and have the potential to not only shape the industry, but also to lower the entry barriers into the DeFi space and ultimately enable more people to benefit from affordable financial services.

What is Staking?

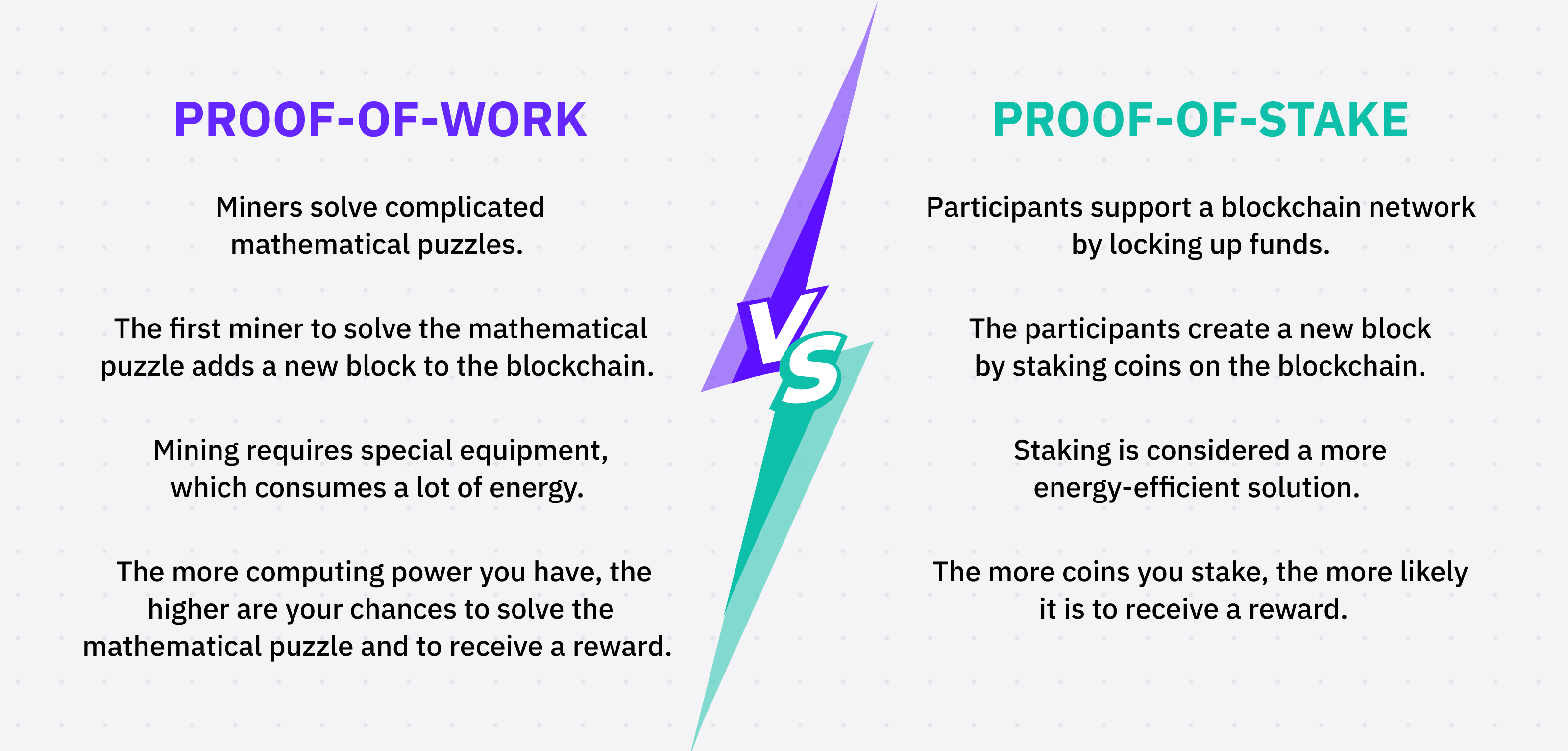

Staking is the second-oldest consensus mechanism and has emerged in response to the growing energy consumption from Proof-of-Work (PoW) protocols such as the one used by Bitcoin. The idea behind this way of validating transactions on the blockchain is different in a way that you do not need expensive hardware equipment to mine new blocks, but rather you have to acquire and set aside a certain amount of coins that validate the transactions on the blockchain. This innovative way of securing the blockchain is known as Proof-of-Stake (PoS).

Just by holding these coins, you become not only an important piece in securing the whole network, but you are also paid for this service. This passive income stream is paid out directly by the in-build emission rate of the blockchain and varies from one blockchain to the other, depending on several factors.

How does Staking work?

If you want to become part of the growing staking community and want to try it out yourself, then you first have to buy a certain amount of coins issued by a PoS blockchain like DeFiChain. After you have completed the purchase and received your coins, you then have to lock away these coins in accordance with the blockchain procedures. This step usually takes less than a few minutes, allowing you to participate in Staking in a jiffy.

Staking has massively grown over the last couple of years due to its attractive reward structure. On the other hand, Staking requires you to lock away a big amount of coins, resulting in rather large upfront investment costs.

However, new concepts mitigate this problem as they allow everyone, also with small amounts, to participate at the lucrative Staking. Cake DeFi is jumping onto this bandwagon as well and is offering one of the best Staking experiences in the industry. Starting with $1, you are able to receive up to 60% APY on your PoS coins without any limitations.

On top of that, Cake DeFi allows you to lock away your Staking coins for even higher rewards. By freezing them for 10 years, you will receive nearly double the rewards you would have received without locking the coins away. This makes most sense, if you want to get long term exposure to the project.

Staking on the surface may look complicated, but Cake DeFi changes that by offering a simple and intuitive platform anyone can use and anyone is familiar with from interacting with a traditional bank account. If you have not yet signed up for an account, then feel free to do so here.

What is Liquidity Mining?

Liquidity Mining is one of the latest trends within the DeFi space and is also gaining momentum among institutional investors. This relatively new technique of distributing rewards to liquidity providers allowed the DeFi space as a whole to increase by a factor of ten during 2020, and this exponential growth is about to continue in the near future.

But before we jump into nitty gritty details of Liquidity Mining, we should first have a look into the term liquidity and why it’s crucial in a decentralized environment. Liquidity essentially refers to a fund’s liquidity, which is defined as the ability to buy and sell assets without causing massive price changes in the asset’s market price. This is key when new projects or new decentralized exchanges launch in the DeFi space.

Liquidity Mining participants are providing liquidity to a blockchain –– most of the time a decentralized exchange –– in exchange for compensation in the form of the blockchains native token. Sometimes these tokens even offer governance rights and allow the holder to actively influence the decision making process of the protocol by voting for or against suggested proposals.

Due to its rather easy workflow, decentralized exchanges (DEXes) are by far the most widely used applications in the DeFi space. As such they are constantly looking for more users, respectively more liquidity locked away on their protocols. Most of these DEXes are using a so-called Automated Market Maker (AMM) to efficiently regulate all sorts of transactions. Yet they also facilitate the swap from one token into another one by building huge liquidity pools consisting of a token pair.

The biggest liquidity pool on our platform in terms of market capitalization is the DFI-BTC pool. This pool allows anyone to swap from DFI into BTC and vice versa for a small fee. Liquidity providers, on the other hand, receive a portion of these fees together with the rewards distributed by the DeFiChain blockchain. Consequently, while the token swapper pays a fee to be given an opportunity to trade on a DEX, the liquidity provider manages to earn money for providing the much sought after liquidity that the user needs.

The underlying mechanism is not only proven by game theory, but it’s also one of the most lucrative ways to earn a sizable amount of passive income in the decentralized finance space. This coupled with an individual yield farming strategy even supercharges your yields into spheres unseen in traditional finance.

Liquidity Mining is not only lucrative but it also offers other benefits. Some of them can be seen in the image above.

One thing is sure though: Applications in the Decentralized Finance space are here to stay and they even conquer more and more areas of the traditional financial space. With more BTC ETFs on the horizon, more fresh money will flow into this space and will not only drive up prices but will also improve the products and make them easier to use.

Cake DeFi already offers one of the most intuitive platforms, offering everyone the possibility to tap into the DeFi space and take advantage of returns unseen in the traditional finance space. If you have not yet registered an account with Cake DeFi, then sign up now and get a $30 signup bonus for free*.

*certain jurisdictions may be ineligible for bonuses