Coin Burning Event And Its Implications For Our Bakers

In this three minute reading article we’d like to give you a short overview about:

- A synopsis of DeFiChain’s emission structure and token distribution

- Possible implications for Cake DeFi Users

We at Cake DeFi may be used to bake around the clock, but burning DFI coins worth millions of US-Dollars is definitely not part of our daily business. Therefore, we’d like to follow up on our latest press release and give you some exclusive insight on what’s going to happen next.

Cake DeFi’s staking and liquidity mining partner DeFiChain put up several proposals to change several mechanics and structures concerning the token distribution and issuance which may directly or indirectly also affect Cake DeFi bakers holding DFI coins. On the other hand, Cake DeFi’s founders and early investors agreed to burn most of their own DFI coins for the greater good - a more decentralized and safe DeFiChain network.

From time to time we also want to give our bakers a glimpse behind our curtains, hence we’ll outline the evolutionary process of DeFiChain’s token distribution and issuance structure in the following paragraphs, before we’ll look at possible implications for our own bakers. We also do think it is important to graphically visualize these groundbreaking changes which are about to happen after the DeFiChain proposals have been accepted.

Token Distribution

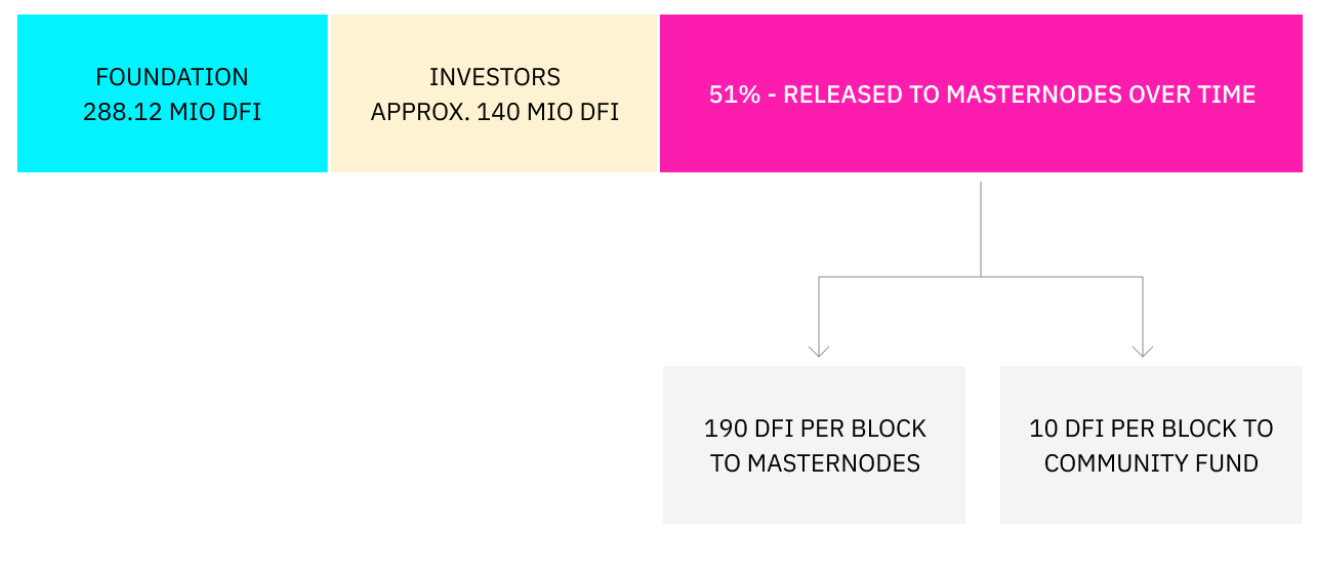

Since DeFiChain mainnet launch in May 2020, the initial token distribution and the DFI issuance structure has changed. In the beginning, 51 percent of the total DFI token supply was reserved for masternode staking rewards and the rest of the total DFI token supply of 1.2b DFI coins was issued to the Foundation (288.12 Mio DFI) and to the team and early investors (approx. 140 Mio DFI coins).

With new DeFiChain product roll-outs and the approval of several improvement proposals, the initial agreed upon block reward payout structure has changed. A total of 45 DFI per block is currently going to the DeFi incentive funding smart contract which periodically pays out the rewards to the liquidity mining pools. The remaining 155 DFI per block is split into 0.1 DFI for block anchoring, 19.9 DFI for the community fund (CFPs) and 135 DFI for masternode staking (see Figure 2).

As of 14 April, the Airdrop Wallet currently holds 1.537M DFI and will be running out of DFI approximately at block height 805,750, or roughly 12 days (around 26 April 2021). This issue causes uncertainty in the community and needs to be addressed sooner than later. Therefore, a new issuance structure shall be put in place after masternodes have been voted and agreed upon.

If the DeFiChain DFIP proposals (DFIP#7 and DFIP#8) which are currently up for vote were to be approved, then the token distribution landscape would look totally different (see Table 3). Most importantly, three things would then happen, which may impact you as a Cake baker as well:

- Firstly, the DFI emission rate would change. This means that less DFI coins per block (in absolute value) would get issued over time.

- Secondly, the 273.714 Mio DFI coins in the Foundation wallet would get burned. These coins would then get added back into the pink box in Figure 3 and would be released over time.

- Thirdly, the investors, currently holding roughly 140 Mio DFI coins, are going to burn most of their own coins. As a result, Cake DeFi related people would then hold roughly 40 Mio DFI in total. The two founders together will then hold approximately 9 Mio DFI.

Implications for Cake DeFi Bakers

Firstly, when it comes to DFI staking and liquidity mining, then Cake DeFi basically depends on what DeFiChain is issuing. The proposed changes above would not change the APY rates for our staking and liquidity mining products during the first cycle of the new issuance structure. As a result, our bakers can still expect to receive the same returns as they are currently used to. Yet, this may change in the subsequent issuance cycles (every 2 weeks a new cycle starts), when less DFI rewards are issued (more on this topic can be found here).

Secondly, the abolishment of the DeFiChain Foundation, respectively the burn of all DFI coins held in wallets which belong to the Foundation, will further decentralize the network and will also take out the speculative element of possible future coin sales by the Foundation. These coins are burned and will be distributed back to stakers, liquidity miners etc. over time. This greatly reduces the circulating supply of DFI coins as well.

Thirdly, the commitment by the founders and the investors to burn their own coins, their own money so to say, in order for the greater good. The investors’ exit agreement will entitle Cake DeFi to initiate a DFI coin burn with a value of approximately US$400m. These DFI were part of the initial airdrop fund to Cake customers in June 2020, but were agreed to be kept in trust by Cake DeFi to ensure none of these amounts were to be sold, staked or utilized for DeFiChain's community voting proposals. The DFI, which accounts for circulating supply, will be sent to a traceable address to be burned, which will be verifiably irrecoverable.

Both coin burns will not only decrease supply but also shows how committed and focused the whole team is to the long-term prospects of Cake DeFi and DeFiChain. In addition, Cake DeFi will openly provide full transparency on the DFI holdings of its current 50-60 “close-to-Cake-related-persons”: After this burn, ex-investors and employees will hold approximately 40 million DFI, or just under 10% of the circulating supply.

The combination of both coin burning events coupled with an increased decentralization mean that a huge chunk of DFI coins is taken out of circulation. If past projects that did the same are any indicator of the future, then it is likely that the DFI coin price could go up. This should actually be like music in your ears, especially for our most loyal bakers who have frozen their DFI for months and years.

At Cake, our team of bakers values your input and feedback above all. You’re the secret recipe to our cake and the reason we continue to innovate and improve our offering to generate tastier rewards and returns.

For discussion & questions, you can join our official telegram group here.

UPDATE May 11: The coin burn had a significant impact on DFI Staking Rewards, which have more than doubled from 37% to over 90% right now! Click Here to register for Cake DeFi & Receive $20 in DFI FREE!