Cake DeFi Transparency Report Q4 2020

In order to give our customers and partners a few insides into what’s happening behind the curtain at Cake, we would like to publish our quarterly board report. Please understand, we have removed sensitive information where necessary. For more information please visit: https://www.cakedefi.com

Below you can see the full text, but if you want, you can access the board reports here:

Agenda

Q4 2020 Executive Summary:

DIRECTIVES Q1 2021:

Q4 Transparency Report Video:

Join us LIVE to discuss the Q4 Transparency Report on 27th January 2021 at 12:00 UTC

We hope you appreciate the insights!

Thanks for your support and happy baking — Have fun! :)

CEO’s REFLECTION ON Q4 2020

Dear community!

Q4 2020 was an absolute essential quarter for us as a company, as it allowed us to prove whether we have it to “become a “teenager” or whether we never manage to grow up from the “toddler” stage, to use the terminology of one of our mentors and good friends:

Looking back over the past few months I can proudly say that as a team we have maanaged to achieve that. Our team now has all the important department heads, we managed to get strong cashflow and our Assets Under Management have gone through the roof. 2021 will be all about to become a “Young Adult”, all the way to a fully “Mature Person”. To use another term of our mentor, this falls into perfect place with the current season of the crypto markets as a whole, where we see the coming of “summer”:

Considering timing plays a huge role in anything, we should not have any excuses for not delivering as a team. So far I can only but say that I am very proud of our entire team, the work ethics and the attitude we approach daily problems with. We achieved one milestone after another all throughout Q4 2020, and I am confident we can keep delivering.

- The major highlight was the start of Liquidity Mining on Cake in December 2020. To date approximately 50 million USD worth of assets have been allocated to this service on Cake.

- We incorporated a fiat onramp partner in October. This allows users to get easy access into the Cake ecosystem.

- Our Staking and Lending services are performing well and in total we managed to grow our Assets Under Management by 340% in Q4. This is truly incredible and well past our target set at the beginning of 2020.

- At the end of 2020 Cake’s user base has grown by almost 100%. Since we went live with our referral program, we have seen consistent user growth of 15–25% per week.

- I am very proud to say that we pay taxes in 2020, making us a cashflow positive and sustainable business. This makes us the exception in comparison to 99% of all other crypto companies in the world.

- We have a solid balance sheet to be very optimistic about our future.

- On the compliance side we were informed by the Singapore government that even as a non-exchange we will have to get regulated under PSA. This is good for our customers, and was expected.

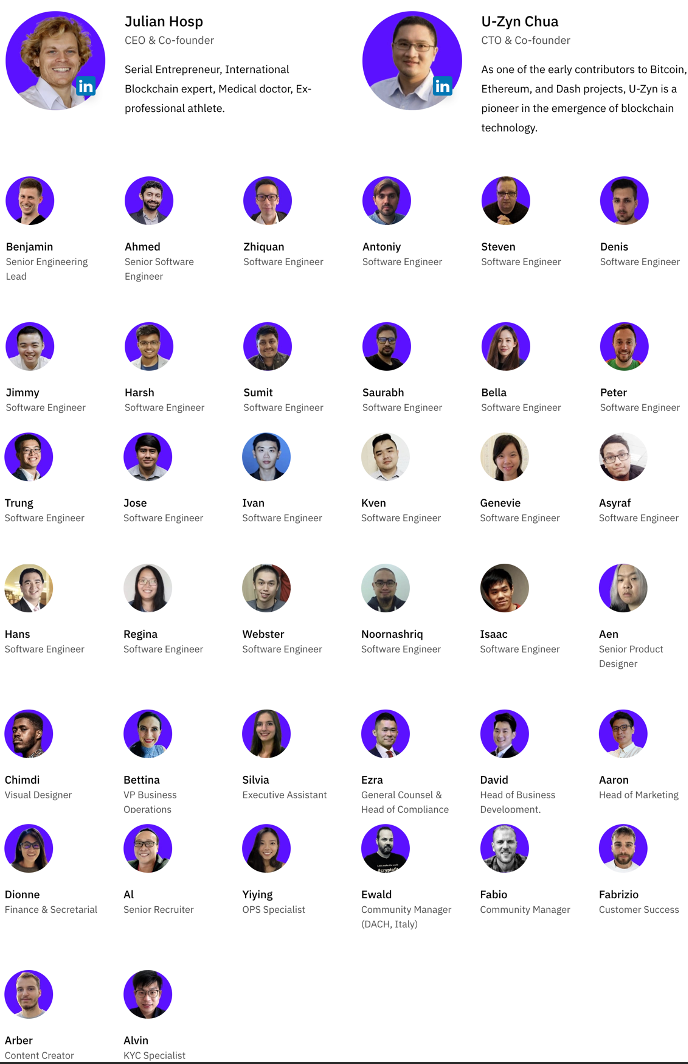

- Our team has now grown by 14 to 42 team members with the majority of the add-ons coming from the tech and product side.

- With our R&D work for DeFiChain Foundation, we helped to bring Liquidity Mining to DeFiChain. This work comes at significant cost for Cake and Cake does not get paid by DeFiChain Foundation directly, however, considering that we get 15% of our users’ staking and liquidity mining rewards, this makes it a win-win-win for DeFiChain, Cake’s customers and for Cake. A similar concept applies in the Bitcoin ecosystem, where many Bitcoin core developers work for regular corporations and develop on Bitcoin for no extra pay other than knowing that this will benefit everyone in the long run. It is all about timehorizon.

Summarizing, I would like to express my gratitude to the entire team that made all this possible with their creativity, hard work and passion.

Please find the details of these highlights laid out in the 10 categories below. You will then find my personal thoughts on the upcoming quarter in the CEO directives.

Thank you for all your support!

Julian

1. FINANCE

- I am very proud to report that Cake had a cashflow positive year of 2020 and will have to pay taxes. Very few companies ever achieve this stage and pretty much no crypto company, so I am very proud of our team to achieve this.

- We have received quite a few offers from Investors. We actually declined an offer for 5 mil USD at a 50 mil USD valuation after consulting with the board of directors.

- We are NOT in need of fundraising and I would only raise funds from investors that can add significant strategic value, such as a large financial institution, a large crypto company, government funds, etc. when we get close to 1 billion USD valuation.

- Our revenue will partly depend on the general crypto market dynamics.

2. SALES & MARKETING

- We successfully hired our head of marketing.

- This is the 2nd quarter where we have more Non-German-speaking users than German-speaking users.

- We started a special sign up promotion where users received a sign-up bonus for their first deposit.

- We ran a promotion to buy Bitcoin & Ethereum with zero Fees in December.

- We started a dedicated Feedback/Superuser UX/UI Group.

- We focused on our Affiliate Program and Affiliate Promotions.

- We used automated emails to bring up deposit percentages.

- We started focusing on SEO a lot more.

- User Growth is phenomenal, especially considering the high numbers we are now talking about:

- Q1 2020: 60% growth

- Q2 2020: 90% growth

- Q3 2020: 174% growth

- Q4 2020: 91% growth - Total Assets under Management have been growing extremely strong every quarter, not only with new users, but furthermore with existing users who keep putting more money onto Cake:

- Q1 2020: 258% growth in AUM

- Q2 2020: 300% growth in AUM

- Q3 2020: 325% growth in AUM

- Q4 2020: 340% growth in AUM - YouTube (https://youtube.com/cakedefi):

- End of Q1 2020: 1,570 subscribers (12% growth this quarter)

- End of Q2 2020: 1,967 subscribers (25% growth this quarter)

- End of Q3 2020: 2581 subscribers (31% growth this quarter)

- End of Q4 2020: 3880 subscribers (50% growth this quarter) - Facebook (https://facebook.com/cakedefi/):

- End of Q1 2020: 571 Followers (4% growth this quarter)

- End of Q2 2020: 864 Followers (51% growth this quarter)

- End of Q3 2020: 1552 Followers (80% growth this quarter)

- End of Q4 2020: 2747 Followers (77% growth this quarter) - Twitter (https://twitter.com/cakedefi):

- End of Q1 2020: 1074 Followers (19% growth this quarter)

- End of Q2 2020: 1,467 Followers (37% growth this quarter)

- End of Q3 2020: 2674 Followers (82% growth this quarter)

- End of Q4 2020: 4353 Followers (63% growth this quarter) - LinkedIn (https://www.linkedin.com/company/cakedefi/):

- End of Q1 2020: 838 Followers (19% growth this quarter)

- End of Q2 2020: 964 Followers (15% growth this quarter)

- End of Q3 2020: 1164 Followers (21% growth this quarter)

- End of Q4 2020: 1898 Followers (63% growth this quarter) - Telegram EN (https://t.me/CakeDeFi_EN):

- End of Q1 2020: 386 Members (21% growth this quarter)

- End of Q2 2020: 508 Members (32% growth this quarter)

- End of Q3 2020: 1133 Members (123% growth this quarter)

- End of Q4 2020: 1892 Members (67% growth this quarter) - Telegram DE (https://t.me/CakeDeFi_DE):

- End of Q1 2020: 1104 Members (10% growth this quarter)

- End of Q2 2020: 1334 Members (21% growth this quarter)

- End of Q3 2020: 1659 Members (24% growth this quarter)

- End of Q4 2020: 2579 Members (55% growth this quarter)

3. COMMUNICATIONS

- Hired our Head of Communications

- Review article published by large crypto influencer Ivan on Tech

- Press release coverage on major sites: Yahoo Finance, Market Watch, Business Insider

- Hired a part-time content creator → First article was successfully published on Traders Mag

- Announcement tweet from official PIVX team

- Created Cake DeFi’s brand narrative, focussing on its value proposition for customers

- Crafted and delivered Cake DeFi’s “brand voice and tonality guide” and general brand guidelines to provide a polished level of communications consistency

- Introduced and on-boarded new PR and multi-format communications agency partners to help elevate and amplify Cake DeFi’s brand awareness amongst influencers, key opinion leaders (KOLs) as well as vertical and influential media

- Delivered a crisis communications handbook, outlining best practices on how to effectively communicate potential issues with customers in a fair and transparent manner

- Identified potential thought leadership opportunities to enhance Cake DeFi’s profile in the vertical

- Ascertained potential opportunities to align with regulatory bodies as a means to inform, educate and support new regulatory framework being introduced

4. TECH & PRODUCT

- We improved quality assurance processes by hiring a new QA engineer.

- All developers are cross-reviewing code from colleagues now, leading to higher code quality and knowledge transfer.

- By re-prioritising goals due to user feedback, we managed to increase user experience very rapidly for certain products.

- Integrated the option to withdraw BTC/ETH/USDT to the DeFiChain network

- Liquidity Mining on Cake → focus on user-friendly experience

- Interface updates: new front-page, new staking page, improved balances page, modals

- Claim 50% discount on DFI to BTC/ETH for Master Bakers

- We look forward to hiring even more JavaScript engineers to reach our goals for 2021 even quicker. If you are interested or know someone who might be, please check out our open positions at http://www.cakedefi.com/jobs

- We onboarded a SysOps engineer to be in charge of overall architecture and management of our increasing fleet of servers and nodes in Q1 2021.

- The QA team will grow by another member, strengthening the quality of the product and new features further.

- The focus for next quarter will be on users being able to file their taxes as easily as possible with Cake tools, as well as increased UX for the platform.

- The engineering team will further help operations to ensure KYC, withdrawals and support can do their work as efficiently as possible

- Give the user the possibility to create a tax report in form of a PDF

- Improved CSV export: show transaction’s FIAT equivalent (in USD, EUR, CHF, …), select date range

- Integration of CSV import with certain partners (e.g. cointracking.info)

- More coin acceptance: Bitcoin Cash (BCH) and Litecoin (LTC)

- Interface updates: New profile page, improved KYC experience

- Auto-stake rewards from liquidity mining

- Performance improvements

- Staying organized and keeping on shipping fast, even with a growing tech and product team

- Helping operations and support with a rapidly growing user base

- Meeting the needs of all users regarding taxes, with users from all over the world and different requirements

- Understanding the requirements of potential partners regarding import of data

5. DESIGN & USER EXPERIENCE

- Liquidity mining user interface with DEX-market price stability visualizer.

- Improved Assets (wallet) interface for consistency across coin types.

- Improved design of product pages, each starting with illustrated intro followed by call-to-actions and listings.

- Confectionery page updates to guide users how much more DFI they need to freeze in order to take advantage of 50% off BTC/ETH promo.

- Designed product-specific settings widget which now lives on respective product page, i.e. staking preferences are now accessible in the Staking page.

- Product illustrations to better differentiate the product pages from one another.

- Assisted front-end team in updating user onboarding and KYC flow which were designed in previous quarters.

- Introduced more UX testing to validate design decisions.

- Visual design of blog.

- Visual assets for various initiatives for marketing and community engagement.

- We want to grow the design team.

- We are working on a Cake mobile app.

- Our product moves fast and design decisions are validated in production. Although it has worked so far, we will need to design and test more before building, as the scale and complexity of our web-app is increasing.

6. OPERATIONS

- A cold wallet facility was started. The cold wallet storage is offering an insurance for funds that are with us, which provides even better assurance for our customers.

- For Customer Support, we have worked on making the response times/ frequency of the agent more efficient

- Expansion of our FAQ section

- There is a VIP tagging for users with more than 100,000 USD AUM, as well as with 1,000,000 USD AUM for increased service and more time-focussed work

- Implementation of separate email address for Masterbakers (VIP Program)

- Implementation of “no-response” email when sending out notifications has significantly reduced “nonsense responses” from users

- For KYC handling we have worked with engineering to implement tools for faster processing of KYCs, such as automated responses via dropdown menu, overview over Countries with most KYCs and audit trails

- SUPERadmins now have access to agent statistics to help with performance reviews and cover any transactions made via admin panel

- We have taken over Operational processing from Engineering for the Liquidity Mining via the Admin panel

- In order to diversify our risks, we are constantly looking for alternative partners for products to work with, and also for our Custodial Wallets, as well as new bank accounts

- We need to expand automations of even more on operational processes to be able to divert workload for team members and keep processes efficient

7. LEGAL & COMPLIANCE

- Updated risk disclaimers when using Cake

- Structuring of an HNWI affiliate program

- Research and negotiation with AML tool providers

- Cake’s license application

- We have been liaising with MAS, who is processing our license application

- Singapore’s law on payment services has changed on 4 January 2021 but MAS has not issued any guidelines on what applicants need to do

- Issuance of Employee share options

- Implementation of periodic user screening processes

- Implementation of transaction monitoring and reporting policy

- Review draft Business Continuity Plan and implement with management

- Law and regulation on crypto is new and developing, which creates much uncertainty

- The scope of Payment Services Act was expanded, but we need to wait for regulatory guidance

8. HUMAN RESOURCES

- After evaluating an all-in solution for all HR processes, which showed to be difficult or not worth the costs at this stage, we introduced an Applicant Tracking System via LinkedIn, to make interview processes smoother

- Defined interview questions and rating system to make hiring more efficient

- We have reduced our work with Hiring Agencies significantly which allowed us to save on costs massively.

- Implemented a health bonus for every employee after probation period

- In Q4 2020 we hired 15 people in Q4 and let go of 1, bringing our total head count to 42:

- 9x Software Engineers

- 2x Blockchain Engineers

- 1x QA Engineer

- 1x KYC Specialist

- 1x JavaScript Engineer

- Focus on maintaining our team culture and team principles during this massive growth period

- We are planning on hiring 12–15 people in Q1 2021:

- 2x Product Designers

- 5x JavaScript Engineers

- 3x Blockchain Engineers

- 1x English/Chinese Content Creator

- 1x English/German Customer Support Agent

- 1x German-speaking Video Editor

9. BUSINESS DEVELOPMENT & PARTNERSHIPS

- Listed Lapis products BTC, ETH, USDT, on CoinmarketCap Interest earning section

- Listed on Trust Pilot — 4.7 / 5.0 score with over 50 ratings

- Launched Private Wealth and Institutional lending page on Cake

- Worked out mechanics for Cake Private Wealth Affiliate Marketing

10. R&D

- Lots of R&D work for DeFiChain Foundation that was laid out in more details in the public DeFiChain Foundation transparency report.

- Focus is on hiring of blockchain developers, especially with live mainnet hard fork experience.

- Publishing of Pink Paper outlining the technical implementations of DeFiChain 2021 roadmap.

- Another focus for 2021 is to make it clear to the community that Cake and DeFiChain are two separate things.

CEO’s THOUGHTS ON Q1 2021

Dear community,

After only our 2nd year we are in a truly excellent position. We have a solid customer base, strong cashflows, money in the bank and a great team. Aside from the strategic positioning and the financial planning I want to highlight the following targeted major milestones for Q1 2021:

- Q1 will be all about UX, UX, UX. User Experience matters. As in: Significantly. A non-crypto-native user has to be able to use Cake with ease.

- We will bring out a mobile app. This is one of the most requested features by our users.

- We will add Bitcoin Cash and Litecoin Liquidity Mining in order to drive even more community engagement.

- Having a head of marketing and head of communications in, I am expecting massive progress in our entire marketing and communications strategy for Q1 2021.

- We are planning on adding around 12–15 new team members in Q1.

- We will continue working with MAS on our PSA application.

- We will start issuing ESOPs or shares to team members. These were already signed off by the board in our shareholder agreement from 2019, and we are considering making them security tokens so team members can maybe trade them in the future, once this becomes available.

- Cake is NOT looking for fundraising, as we are in a very strong financial position.

Most of the things described above are straight forward. You will find some further insights and background information on the following pages on a few more points.

Thank you for all your support!

Regards,

Julian

DISCUSSION POINTS & BOARD DECISIONS

1. 2021 Budget Approval

Background:

- I would like to approve the budget for the entire year and in case we significantly over- or underperform adjust it during our quarterly meetings.

Discussion Points:

- I am more confident about our revenue in the short term than in the long term due to the unpredictable nature of the cryptocurrency markets.

- Most of the budget is actually covered by our current holdings, so there is very little risk of us running out of money or needing fundraising.

- I would like to significantly increase the marketing budget especially if our revenue numbers are going well. My suggestion would be to getting 50% additional budget of any revenue amount we are over the planned budget. This leaves some buffer but gives me freedom with added extra spending.

Decisions to vote on:

- Is the board of directors approving the 2021 budget as long as the quarterly revenue numbers are being met?

APPROVED

- Is the board of directors ok in adding additional marketing budget if the revenue numbers are superseded?

APPROVED

2. Product Strategy 2021

Background:

By the end of 2021 I would like Cake to come pretty close to its vision of being a 1-stop-platform for all finances. I think we have most of the product puzzle pieces, and I want everyone in the same boat before we start assembling them.

We have two options to go about this:

- We can do this in a straightforward and boring route by offering the services as we have done so far. The straightforward route will keep generating some nice cashflow for now, but it will never change the world. If we keep on this path, I am 99% sure we will be a cashflow positive business for the next couple of years. We will be competing with many other companies and our exit is to be bought out by a larger player for a small or medium sum.

- Option number two is to completely disrupt the financial system. The disruptive way on the other hand, may change the world, but we may fail. We will not compete with other companies, because there are no other companies doing this. We can definitely limit our downside here, but the aim here is to go all out, do an IPO and change the world.

Discussion Points:

Thinking from first principles, we can ask ourselves what are the main hurdles companies in the fintech space have to solve:

- Financial Literacy/Education in general.

- Access to the company/protocol, especially for users in excluded jurisdictions or users who are being excluded due to local regulation.

- User Experience, which is a general first principle problem for companies.

Most financial institutions skip the first step, offer the second step with heavy KYC and AML regulation and thus deliver a horrible step three to their customers. I believe that at Cake we can completely disrupt this process if we choose the second and disruptive option:

- We attract buy and hold investors rather than traders — especially at the beginning.

- We offer them a seamless and frictionless way into all financial assets from whatever asset they already own (probably fiat).

- We offer them the 6 main investment classes that people generally invest in:

a) Securities (Stocks and Bonds)

b) Commodities

c) Precious Metals

d) Currencies

e) Collectibles

f) Cryptocurrencies - We offer access to these with the same easy Digital Payment Token compliance requirements that cryptocurrencies fall under. We do this by decentrally tokenizing the other investment categories, and them therefore also becoming DPTs and not falling under the heavy regulation.

- We then trailblaze a new way for the financial ecosystem, completely disrupting the space.

The financial space has never been disrupted because any company that tried to, fell under regulation because they could not change the nature of the investment. We have legal opinions that this will work, albeit being in a gray area. But this is how all disruptive companies operate: You push the boundaries.

If we achieve these 5 steps, we would be able to offer any financial product to any FATF regulated country in the world (approx. 195 countries), without having to apply for new licenses like any other company has to. Going this road would make us disruptive. We would not compete with anyone that I know of. We can scale at speeds that all other companies are only dreaming about. But, we may not succeed. It is the road untested.

Decisions to vote on:

- Route 1 or 2? Boring or exciting? Straightforward or moonshot? Multi-millions or Multi-Billions? Competitive or Disruptive?

APPROVED ROUTE NR. 2

3. Fundraising 2021

Background:

If approved, the budget will put us in a strong position to gain market share in the space, and it is unlikely we will need any additional funding. I do however see the need for large governmental, financial or institutional partners for our undertaking from a strategic side, especially if we choose to go the disruptive route.

Discussion Points:

Having a large strategic partner will be vital when it comes to us completely disrupting the financial space. We will need large institutional support. It will also help us with users’ trust and our reputation. Being “a unicorn” drives attention. The key point here is to only do this strategic investment once we actually hit the unicorn status, not earlier. This would solidify our position and could also allow some early investors or employees to have a small cash out to secure their financial future in case our large undertaking fails. Obviously, there will be the downside of this partner wanting to have a say in our operations and the upsides will have to outweigh the downsides, but I would strongly recommend us considering this. Since such an investment takes months to prepare, I have to stay on top of that now already. The actual investment would have to be approved separately anyways according to the shareholders’ agreement.

Decisions to vote on:

- Should Cake explore a strategic fundraising opportunity at at least 1 billion USD valuation from a governmental, financial or large institutional partner in 2021?

APPROVED TO WATCH AND REVISIT IN Q2

4. Approving, Rejecting or Adjusting CEO’s OKRs & No-List

Background:

Every year and every quarter, the board of directors lays out several OKRs and their action items for the CEO to work on. Additionally, there is a No-list of things that the board of directors does not want the CEO to work on. You may find both at the very end of this document.

Discussion Points:

The board of directors may approve, reject or adjust any point in the OKRs before it comes to a vote on Cake’s CEOs OKRs and No-List. These discussions may happen at this point.

Decisions to vote on:

- Is the board of directors approving the CEO’s OKRs for 2021 as a whole?

APPROVED

2. Is the board of directors approving the CEO’s OKRs for Q1 2021?

APPROVED

3. Is the board of directors approving the CEO’s No-List for Q1 2021?

APPROVED

CEO’s OKRs & NO-LIST

2021 Annual OKRs

OKR 1: Be a disruptor of the traditional financial system

We achieve this by offering the six investment categories of cryptocurrencies, securities, precious metals, commodities, currencies and collectibles as digital payment tokens to our users in all FATF regulated countries, who will be able to invest in these either individually or in the form of algorithmic funds with the simple click of a button and without the traditional heavy regulations.

OKR 2: Be a sustainable and cashflow positive company

We achieve this by having enough revenue from our customers’ Assets Under Management to pay for our expenses.

OKR 3: Be a unicorn

We achieve this by having a highly strategic investor such as a government, financial institution or large VC firm coming in at least at a 1 billion USD valuation.

Q1 2021 OKRs

OKR 1: Be ready for non-crypto users

We achieve this by working and fine-tuning our product offering, working on our user experience and offering a mobile app.

OKR 2: Be a sustainable and cashflow positive company

We achieve this by having enough revenue from our customers’ Assets Under Management to pay for our expenses.

OKR 3: Be on the road to become a unicorn

We achieve this by our team members becoming Cake and DFI owners, thereby having skin in the game.

NO-List for Q1 2021

- Less focus on staking, and more on DeFi.

- No integration of Ethereum DeFi

- No exchange service by Cake

We are looking forward to your feedback and questions in the comments.

We will keep focusing on our mission to bringing you cashflow from any type of blockchain asset in the most transparent and most attractive way possible in order to build a one-stop platform for you to manage all your finances in an automated AI-supported manner — be it crypto, real estate, stocks, gold, and much, much more.

We appreciate your trust and business.

Your Cake Team

LINKS & RESOURCES

Official Website: www.cakedefi.com

Twitter: www.twitter.com/cakedefi

Medium/Blog: https://medium.com/@cakedefi

Facebook: https://www.facebook.com/cakedefi

YouTube: https://www.youtube.com/cakedefi

LinkedIn: https://www.linkedin.com/company/cakedefi

Reddit: https://reddit.com/r/cakedefi

Telegram English: https://t.me/CakeDeFi_EN

Telegram German: https://t.me/CakeDeFi_DE

Telegram Italian: https://t.me/CakeDeFi_IT

Media & press resources: https://www.cakedefi.com/press/

For media inquiries, please contact: david@cakedefi.com

Interested in working at Cake? Here are all the positions we are currently looking for: https://cakedefi.zohorecruit.com/jobs/Careers

DISCLAIMER

This transparency report does not constitute nor imply a prospectus of any sort. No wording contained herein should be construed as a solicitation for investment. Accordingly, this transparency report does not pertain in any way to an offering of securities in any jurisdiction worldwide whatsoever. Rather, this transparency report constitutes a description of the development and distribution of Cake. Do not trade or invest in any tokens, companies or entities based solely upon this information. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. Investors should conduct independent due diligence, with assistance from professional financial, legal and tax experts, on topics discussed in this document and develop a stand-alone judgment of the relevant markets prior to making any investment decision.

This document does not constitute nor imply a final technical specification of Cake. Information presented in this transparency report, technical or otherwise, is meant to outline general ideas, designs and use-cases and is subject to change with or without notice. For the latest up-to-date technical specifications, check out the updates and documentations on the official website www.cakedefi.com. The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

While this transparency report was compiled with the greatest care possible, it cannot be guaranteed that all information is complete or accurate. The information contained in this document may include, or incorporate by reference, forward-looking statements, which would include any statements that are not statements of historical fact. No representations or warranties are made as to the accuracy of such forward-looking statements. Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. These forward-looking statements may turn out to be wrong and can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, most of which are beyond control. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. For any questions on a specific subject covered in this document, please contact us at partners@cakedefi.com

Cake Pte Ltd is registered in Singapore with UEN 201918368M at 7 Temasek Boulevard #12–07, Suntec Tower One, Singapore, 038987.